In the field of accounting, a Chart of Accounts (COA) is a categorized list of all the financial accounts of a business, representing its assets, liabilities, equity, income, and expenses. It provides a systematic approach to organizing and recording financial transactions, enabling businesses to track their financial health and generate essential reports.

What is a Chart of Accounts?

Definition of Chart of Accounts

The Chart of Accounts is a fundamental aspect of accounting that outlines the financial structure of a business. It consists of a comprehensive list of all the accounts used by an organization to record its financial transactions, providing a clear understanding of its financial position.

Importance of a Well-Organized Chart of Accounts

A well-organized Chart of Accounts is crucial for accurate financial reporting and decision-making processes. It ensures that all financial transactions are recorded and classified correctly, leading to effective analysis and management of the company’s resources.

Examples of a Chart of Accounts

Examples of accounts that can be found in a Chart of Accounts include asset accounts, liability accounts, expense accounts, revenue accounts, equity accounts, and more. Each account is assigned a unique account number for identification and tracking purposes.

How Does a Chart of Accounts Work in Accounting Software?

Integration with General Ledger

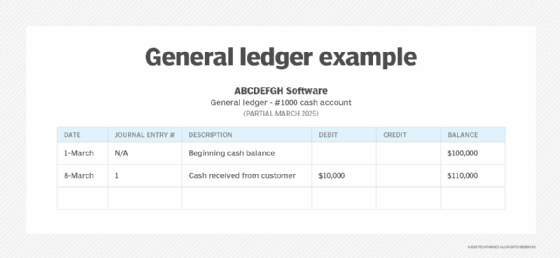

The Chart of Accounts in accounting software integrates with the general ledger, where all financial transactions are recorded. This seamless integration ensures that each transaction is accurately categorized and reflected in the appropriate accounts.

Generating Financial Statements

Through the Chart of Accounts, accounting software can generate essential financial statements such as the balance sheet and income statement. These reports offer a comprehensive overview of the financial status and performance of the business.

Types of Accounts Used in Chart of Accounts

The Chart of Accounts encompasses various types of accounts, including asset accounts, liability accounts, equity accounts, expense accounts, and revenue accounts. Each account plays a vital role in capturing different aspects of the company’s financial activities.

Why is a Chart of Accounts Important for Small Businesses?

Accurate Financial Reporting

For small businesses, a well-structured Chart of Accounts is crucial for ensuring accurate and transparent financial reporting, which is essential for regulatory compliance and stakeholder confidence.

Tracking Specific Accounts

A Chart of Accounts enables small businesses to track specific accounts relevant to their industry and business function, allowing for better analysis and decision-making.

Facilitating Financial Transactions

By providing a systematic framework for recording financial transactions, the Chart of Accounts facilitates smooth and organized financial operations for small businesses.

How is a Chart of Accounts Organized?

Types of Main Accounts

The Chart of Accounts is organized into different main account types, including assets, liabilities, equity, income, and expenses. Each main account type contains subcategories that further classify the financial transactions.

Sorting Account Types in General Ledger

Within the general ledger, the accounts in the Chart of Accounts are sorted and organized based on their nature and function, ensuring that all financial data is systematically recorded and easily accessible for reporting and analysis.

Main Account Types in Chart of Accounts

The main account types in the Chart of Accounts form the foundation for the entire financial structure of the business. They provide a comprehensive framework for capturing and organizing all financial activities.

What Are the Types of Accounts Included in a Chart of Accounts?

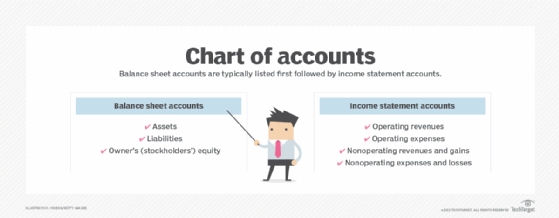

Balance Sheet Accounts

Balance sheet accounts reflect the financial position of a business at a specific point in time, including its assets, liabilities, and equity. These accounts provide a snapshot of the company’s financial health and stability.

Income Statement Accounts

Income statement accounts, also known as revenue and expense accounts, capture the company’s financial performance over a period by recording its revenues and expenses. They play a key role in evaluating the profitability of the business.

Equity Accounts

Equity accounts represent the ownership interest in a business and include accounts such as common stock, retained earnings, and additional paid-in capital. These accounts reflect the shareholders’ equity in the company.

What is the purpose of a chart of accounts?

In practice, the COA serves as the foundation for a company’s financial record-keeping system. It provides a logical structure that facilitates the addition of new accounts and the deletion of old accounts.

The organization of accounts within the COA varies from company to company. It usually consists of the accounts that a company has identified and made available for recording transactions in its general ledger. This can be done with accounting software.

For ease of use, a COA contains the list of accounts’ names, brief descriptions, account type, account balance and account codes for each sub-account.

Sample chart of accounts

To better understand this, consider your personal financial statement. Let’s say you have a checking account and a savings account. You regularly use your checking account for your day-to-day expenses. Further, you also use two credit cards regularly.

Your financial statement will provide details of the cash flow (i.e., credit and debit balance). This includes your monthly income, expenses and debt. The same, when produced for a company, is the COA.

Within the COA, accounts will be typically listed in order of their appearance in the financial statements. Typically, balance sheet accounts, including current assets and current liabilities, are listed first.

This is followed by the income statement, which includes revenue and expense accounts. This can be further divided into operating expenses, operating revenues, nonoperating expenses and nonoperating revenues.

A COA for a small business might have the following sub-accounts:

Asset accounts:

- Cash

- Savings account

- Prepaid expenses

- Accounts receivable

- Real estate

Liabilities accounts:

- Accounts payable

- Accrued liabilities

- Income tax payable

- Depreciation

Creating a chart of accounts

A chart of accounts will likely be as large and as complex as a company itself. An international corporation with several divisions may need thousands of accounts, whereas a small local retailer may need as few as one hundred accounts.

An important purpose of a COA is to segregate expenditures, revenue, assets and liabilities so viewers can quickly get a sense of a company’s financial health. A well-designed COA not only meets the information needs of management, it also helps a business to comply with financial reporting standards.

A company has flexibility in creating a COA that suits its needs. Within the categories of operating revenues and operating expenses, for instance, accounts might be further organized by business function or by company divisions. They need to be mindful of the Generally Accepted Accounting Principles and the Financial Accounting Standards Board, however.

Companies should also ensure that the COA format remains the same over a period of time. Changes to a COA in the short term can make it challenging to analyze the difference in a company’s financial health over the long term.